The website welcomes anyone to register and connect with investment education companies, regardless of their educational background, location, gender, or career paths. After registering, people can choose their courses and develop key financial abilities.

Anyone ready to acquire investment education can sign up on Tradynator for free. Registering on Tradynator is fast and has no complexities. People should fill out the sign-up form with their names, email addresses, and phone numbers. Investment teaching firms’ representatives will contact each registration with more information and guidance.

Tradynator welcomes everyone to register for investment education despite the possibility of their educational background being different. Everyone can register, connect, and learn, whether they learned medicine, marketing, journalism, or law in school. Register on Tradynator to connect with investment tutors and start learning.

Despite people’s current or future careers, investment education is essential, as it is an extra source of knowledge and skill.

People can use the knowledge from investment studies at their jobs or careers for financial management, personal development, and critical thinking. Register on Tradynator to connect with an investment teacher.

With Tradynator, location is not a barrier to connecting with investment education companies and acquiring knowledge.

Tradynator connects people worldwide with investment education companies to learn virtually. Sign up on Tradynator to connect with investment education companies.

Tradynator does not require that registrants be tech-literate before registering or connecting. Sign up on Tradynator to connect with investment teaching companies.

At the point of registration, Tradynator does not request sensitive documents - driving license, photographs, social security number, or credit card numbers - from people. Register on Tradynator with only names, emails, and phone numbers, and connect with investment tutors.

Tradynator does not require payment for registering and connecting potential investment learners. Register and connect with investment education companies at zero charge.

Despite an investor’s aim to get expected returns, it is not guaranteed because of risks. An individual investor invests in smaller quantities and buys stocks in round numbers (like 100, 75, 50, or 25). Many individual investors invest by emotions and choose their stocks with fear because of market volatility. To learn more about individual investors, register on Tradynator.

Tradynator defines an institutional investor as a company that pools funds from various investors to invest in different securities. This investor deals in several markets and securities and can influence securities’ demand and supply. Also, it serves as a source of capital for publicly traded organizations.

However, if this investor decides to switch its position in publicly traded companies, they (the companies) might go bankrupt. Tradynator outlines institutional investor types below:

A hedge fund usually has a fund manager called the general manager and lists of investors referred to as limited partners. The fund is designed to seek returns through a diversified portfolio. It uses an aggressive investment approach, making it riskier. Learn more about hedge funds by registering on Tradynator.

A mutual fund offers various investment strategies and styles and is run by professional money managers. It gives investors exposure to all the investments and income in the fund. Also, it allows diversification and attracts low transaction costs but is prone to inflation risk. Register on Tradynator for more information.

Pension Fund

A pension fund pools money from employees for repayment after retirement. To learn more, register on Tradynator.

Insurance Company

An insurance company invests the premium from policyholders into securities. For more information, sign up on Tradynator.

Endowment Fund

An endowment fund is created to fund activities and not-for-profit organizations.

Types of endowment funds are term, restricted, unrestricted, and quasi. Term endowment funds are those whose principal can be used after a particular time or event. Restricted endowment funds have limitations in their capital use, while unrestricted endowment funds do not. Quasi-endowment funds are not obligated to exist forever. That is, their principal can be spent at some point. Connect with investment tutors on Tradynator to learn more.

An anchor investor subscribes to initial public offerings (IPOs) before they are available to the general public. This investor buys shares early, boosts IPO credibility and attractiveness, and provides confidence to investors in the market. The existence of anchor investors can bring about high share demand and subscription rates, helping companies possibly achieve better pricing for shares. To get more detail, register on Tradynator.

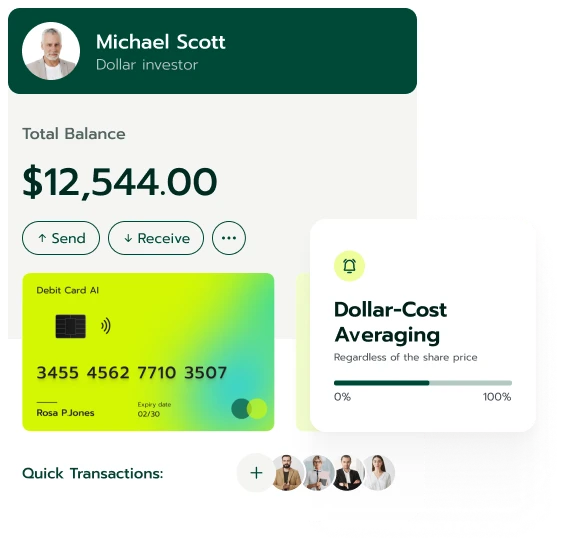

A bear market signifies a lengthened period of investment price fall by 20% or more. This market can remain for weeks to a year. The Great Depression, the dot-com bubble in 2000, and the housing crisis in 2007 are examples of bear markets. Investors in a bear market are often worried and afraid to invest. In this market, investors diversify their holdings, focus on the long-term, use dollar-cost averaging, and invest in sectors that perform in recessions.

Investors determine the imminence of a bear market by watching if the Federal Reserve lowers interest rates. Instead of predicting the market, long-term investors fund their portfolios with the money they don’t need in five years. The portfolios also align with their risk tolerance and are diversified. Get more information about bull and bear markets by registering on Tradynator.

The financial market types are money, stock, cryptocurrency, commodities, capital, forex, and bond markets. The money market allows trading short-term debt instruments. People can invest in money market funds such as U.S Treasury bills, Municipal notes, and short-term certificates of deposits. This market involves wholesale-level and large-volume trades between institutions and traders. A money market has low risks and is highly liquid but generates low returns that inflation might overpower.

A stock market is the platform for issuing, buying, and selling stocks. This market allows companies to access capital from the public to fund and grow their businesses. Also, it allows investors to share in the gains of publicly traded companies. People invest in a stock market by choosing investment strategies, diversifying their portfolios, and monitoring and adjusting their investments. Tradynator explains other markets below:

A cryptocurrency market permits swapping, buying, selling, and storing cryptocurrencies such as Bitcoin, Ethereum, Solana, Cardano, Binance, Dogecoin, and Tether. The market is decentralized and runs on a network of computers. Cryptocurrency investment allows easy fund transfer and streamlined remittances but has price volatility and may be used for criminal purposes. Register on Tradynator for more details.

Products are traded on a commodity market. These products include gold, oil, wheat, and jewelry. A commodity market trades two types of commodity options - call and put. A call option gives holders the right to buy commodities, while a put option gives the right to sell them. Connect with investment tutors on Tradynator to learn more.

A capital market is the platform where individuals, businesses, and governments exchange funds with investors and banks. The market is divided into primary and secondary markets. Bonds and stocks are issued and sold on a primary market, while a secondary market trades existing securities between investors. To learn more, register on Tradynator.

A bond market is where governments and companies issue bonds. Governments issue bonds to finance infrastructural projects and pay debts, while companies do so to grow product lines, expand, and maintain operations. Register on Tradynator to learn more.

Advantages of PI include its ability to rank and choose between projects when capital is rationed. However, it might not help make correct decisions in mutually exclusive projects with different initial investments. Learn more by signing up on Tradynator.

The growth investing strategy involves seeking companies with above-average earnings growth. A growth investor considers margins, returns on equity, and historical and future earnings when evaluating stocks. Register on Tradynator to learn more.

Value investing focuses on stocks that trade for less than their intrinsic values. A value investor values a company’s stocks with free cash flow, price-to-earnings, and price-to-book metrics. To learn more, sign up on Tradynator.

Capital structure is a company’s mix of debt and equity to fund its operations. A company’s balance sheet shows its capital structure. Analysts and investors use capital structure to decide what company to invest in. To decide this, they check the company’s debt-to-equity ratio. Register on Tradynator for more details.

A sellout is an involuntary asset sale caused by non-economic issues like death and divorce. Sign up on Tradynator for more details.

This is an incurred cost in financial transactions. Want to know more? Register on Tradynator.

This financial theory claims that issuing dividends does not increase a company’s stock price or profitability. Sign up on Tradynator for more information.

An expense ratio is the fraction of a fund’s assets used to cover operating and administrative expenses. Get more details by signing up on Tradynator.

Liquidity signifies how easily investors can convert their assets to money. Learn more by registering on Tradynator.

A benchmark is the standard for measuring an investment’s performance. Register on Tradynator for more information.

| 🤖 Cost to Join | Sign up at no cost |

| 💰 Service Fees | Absolutely no charges |

| 📋 Enrollment Process | Quick and easy sign-up process |

| 📊 Learning Areas | Training on Crypto, FX Trading, Equity Funds, and More |

| 🌎 Regions Served | Serviceable in almost all nations but not in the USA |